For Middle Aged

Financial Freedom with Madhyama Plan

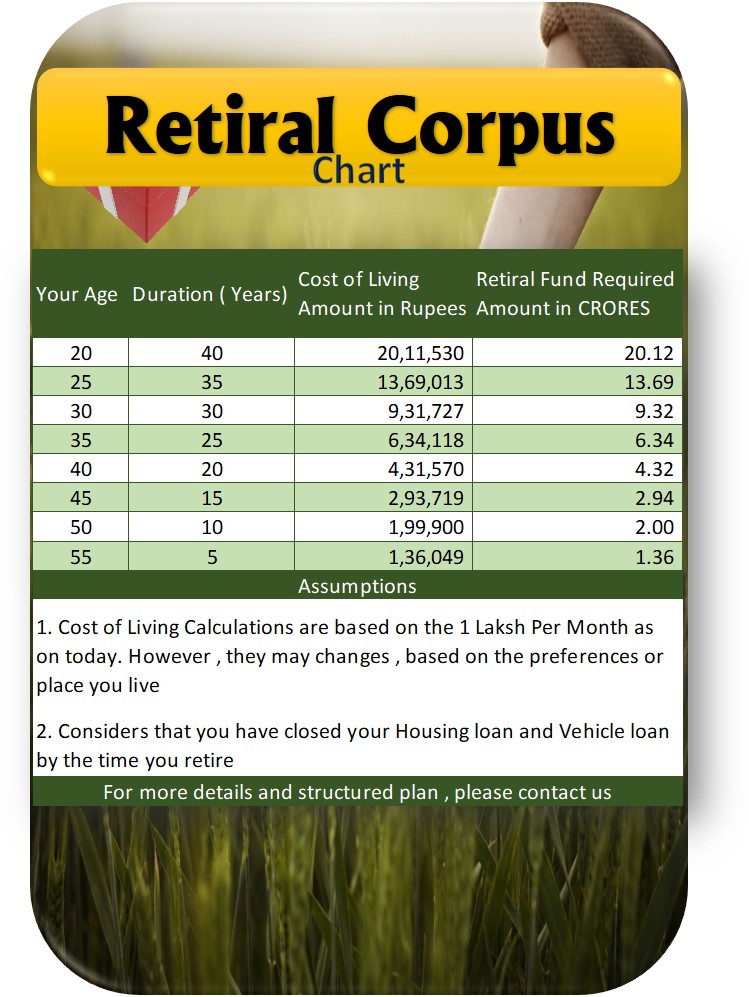

This plan is tailored for individuals approximately 40 years old, aiming to build the necessary retirement funds. It emphasizes the idea that it's never too late, providing a safeguard for the individual's retirement journey.

As you are aware, retirement constitutes a crucial phase of life. Ensuring a stress-free retired life is paramount, and a well-structured financial plan plays a pivotal role in achieving this goal. Aranya Krishi offers an excellent solution to facilitate a joyful and worry-free journey through your retirement years.

How it works ?

Acquire 200 plants for 15 lakh INR. If making a one-time investment of 15 lakh is challenging, flexible installment options are accessible.

After 10 years, you will receive a sum of 1.00 crore INR. This income is derived from agriculture, making it exempt from taxes based on current regulations.

Reinvest 1.00 crore INR to a Lumpsum SIP Scheme for a duration of 10 years, expecting a potential return on investment (ROI) of 15%.

Through a Lumpsum SIP investment, you can anticipate accumulating 4.04 crore after 10 years, reaching this milestone by the time you turn 60 years old.

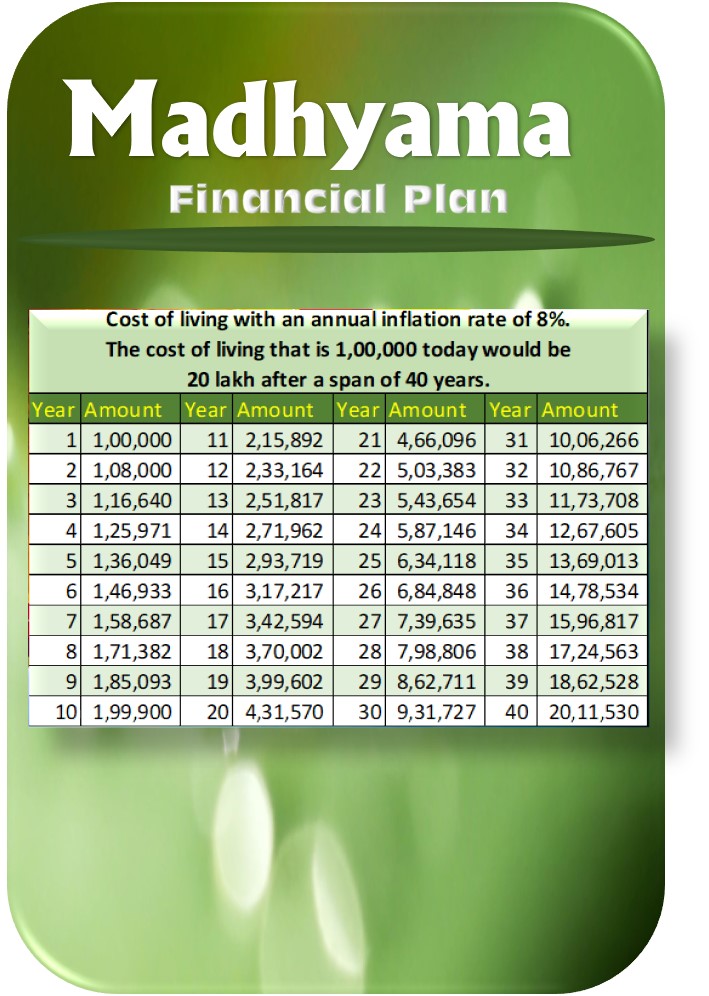

The retirement fund can be directed towards monthly return schemes with a potential 12% return on investment (ROI). This could result in an approximate monthly income of Rs. 4.00 lakh. Considering current expenses at 1.00 lakh, inflation on the cost of living over 20 years would necessitate 4.00 lakh INR for the same lifestyle.

If you require more or less money, you can adjust your investment fund within the retiral fund. Our financial advisors will engage in discussions with you and provide guidance on suitable adjustments.

Immeditate action

Contact us to discuss and create a personalized plan tailored to help you achieve your retiral fund goals.