Apt for Youngsters

Financial Freedom with Prathama Plan

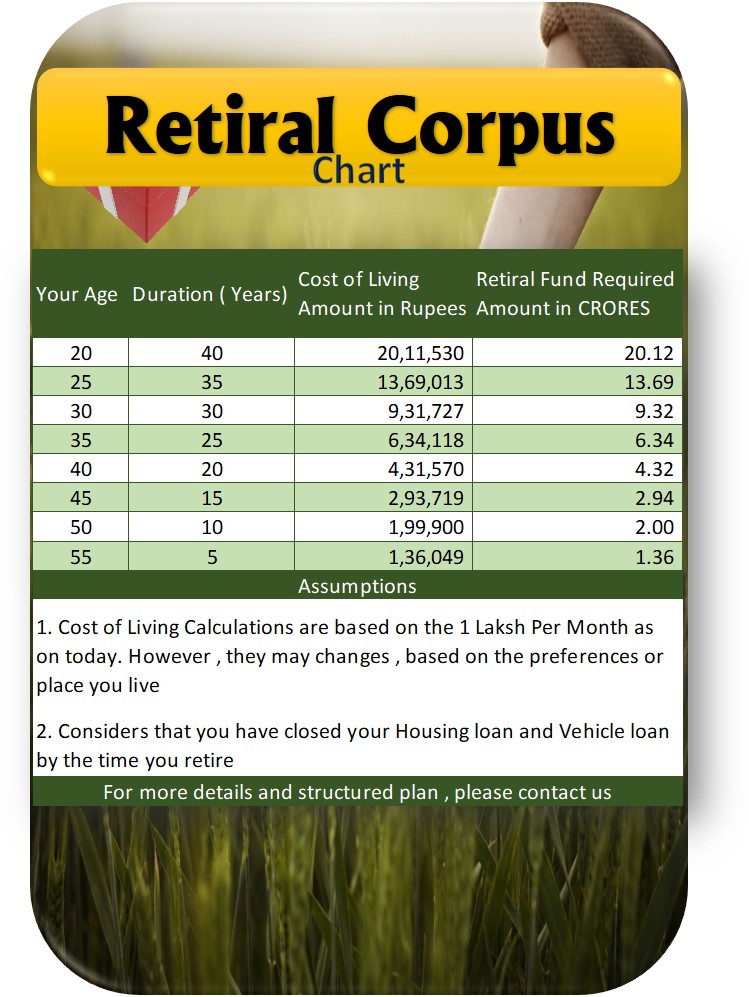

This program is specifically designed for individuals in their mid-20s, just beginning their careers. It aims to establish a retirement fund of 11 crore with an investment of 9 lakh.

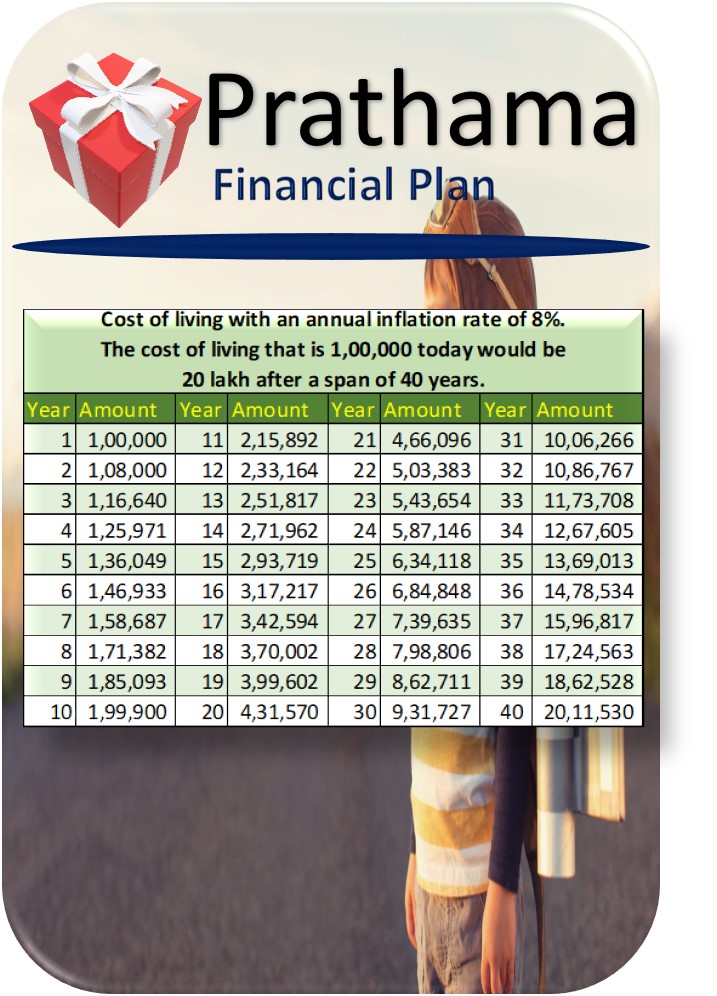

As you are aware, retirement constitutes a crucial phase of life. Ensuring a stress-free retired life is paramount, and a well-structured financial plan plays a pivotal role in achieving this goal. Aranya Krishi offers an excellent solution to facilitate a joyful and worry-free journey through your retirement years.

How it works ?

Allocate a monthly investment of Rs. 7,500 to acquire a teakwood plan for a duration of 10 years. Starting from the 11th year, you would get Rs. 50,000 each month for the subsequent 10 years.

Your initial investment of Rs. 9,00,000 contributes Rs. 60,00,000 to your retirement corpus as the first step.

Scenario:Age : 25 Years

- Buy one plant at Rs.7500 every month towards your rertiral corpus.

- By buying one plant every month for 120 months , you are investing 9 Lakh INR towards your retireal corpus

- Starting from the 11th year onwards, Aranya Krishi will provide a monthly payment of Rs. 50,000 to the members of this plan for a duration of 10 years.

At the age of 35

- Reinvest the Rs. 50,000 received from Aranya Krishi into a Monthly Systematic Investment Plan (SIP) with a 15% return rate for a period of 10 years.

- Upon completion of the 10-year SIP duration, you would accumulate a total of 1.39 Crores INR.

At the age of 45

- Invest the amount of 1.39 Crores INR into a Lumpsum Systematic Investment Plan (SIP) with a 15% return rate for a period of 15 years.

- From the Lumpsum SIP, you will receive a retiral fund amounting to 11.33 Crore INR.

At the age of 60

- Investing 11.33 Crore INR in monthly returns schemes with an approximate 12% ROI would create a comfortable fund to manage your monthly needs.

Immediatate action

Contact us to discuss and create a personalized plan tailored to help you achieve your retiral fund goals.